Allied Health specialists make up nearly 60% of the total workforce in the healthcare industry. Good staffing is essential for providing top-notch care to patients.

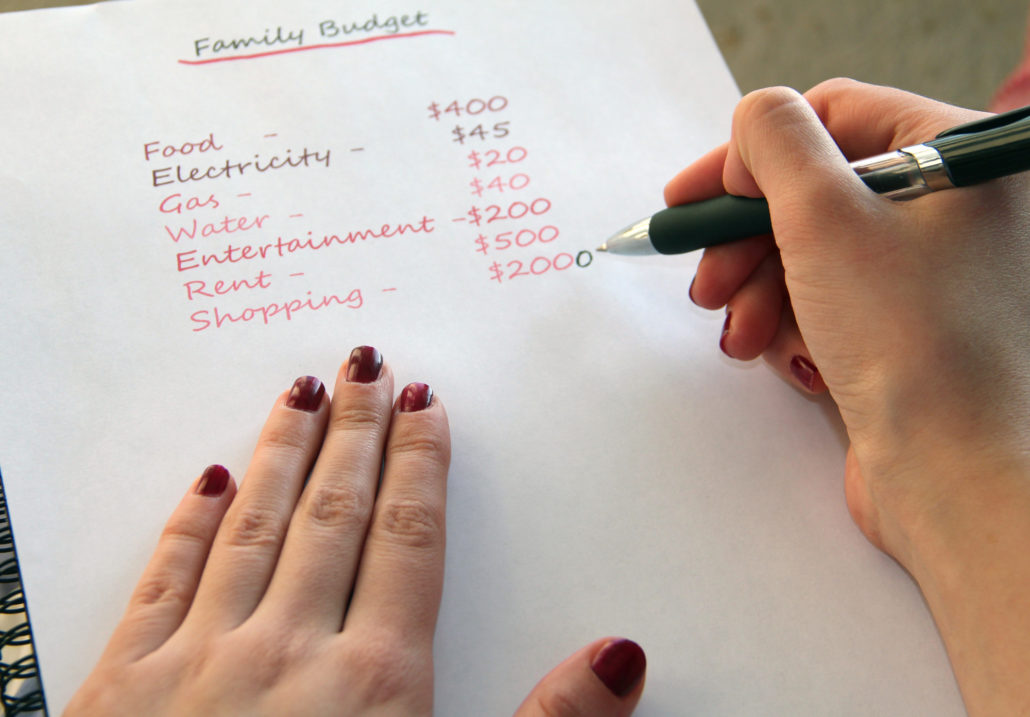

But there is another often overlooked facet of ensuring your Allied Health practice runs smoothly. Budget management.

Budget management can be tricky to navigate if you don’t have the right budgeting software. There are so many expenses to track and manage between your office budget and the practice budget that you must consider.

If you’re looking for the right budget management software to help your Allied Health practice, this guide can help. Keep reading below for 7 tips you can use to choose the best budgeting software.

1. User-Friendly Interface

Finding a budget management software system is only one part of the problem, you must also find one that offers ease of use. You don’t want to spend all of your time flipping through use manuals trying to figure out how to use your software. That would defeat the main purpose of using budgeting software to simplify your life in the first place.

Some budget management software enables drag-and-drop functionality. This allows for easier uploading of documentation to the system, so there’s no need for manual entry. It’s quick and simple.

You can create a budget and view it in real-time for more effective ways to budget. No more messy and error-filled ledger books or expensive accountants are required to track your budget and expenses.

2. Budget Management Flexibility

Choosing a good budgeting software means looking for one that isn’t a standard one-size-fits-all version. You want budget management software that offers you flexibility. This means you can tailor it to whatever use you need.

For example, your office budget and your practice budget are two different areas. Your office budget covers exclusively those who work in the front and back of your office. Handling tasks such as patient records, billing, appointments, and more.

While your practice budget encompasses areas like electrical expenses, building maintenance and upkeep, and rent payments. It can also cover budget staffing. The average healthcare practice organization often spends 40% of its budget on its nursing staff.

With a flexible budget management software program, you can create the specific budget areas you want. While also keeping the expenses separate for each section.

3. Allows for Simple Budget Management Options

Budget management software allows you to keep track of your finances. With the right budgeting software, all of the information you need is laid out in an easy-to-read understandable format. Accompanying charts and graphs show you what portions of your budget are allocated to each area of your practice.

You can enter the data to see a projection of overall costs before spending. This comes in handy if you want to play around a little bit with reallocating some funds differently. Or for possibly spending some more on a certain area.

This way you can view potential budgeting changes ahead of time to make sure that you don’t exceed the maximum budget cap for the year.

4. Accessibility from Anywhere

The right budget management software lets you access your data from a dedicated cloud-based system. So you don’t have to be chained to one computer with your bookkeeping data on it.

You can still access your budgeting data from a secure log-in portal on your web-enabled phone, tablet, or laptop from wherever you are. Even if you manage multiple centers. You can also view real-time reports anytime you want to.

Cloud-based access displays current spending year to date against the projected budget. This makes it easy to see exactly where you stand before you commit to any extra expenses like hiring additional staff.

You’ll always be in the know about your budgeting needs with cloud-accessible budget reports.

5. Offers an All-in-One Integrated Platform

In this technological era, you don’t want to have to use a different software platform for each aspect of your Allied Health practice. This can become confusing and lead to errors and miscalculations of data.

Opt for budget management software that offers an integrated platform. Combining billing, scheduling, and budgeting all in one.

You can also choose budgeting software that integrates with your existing financial software. This allows for simpler importing and exporting of data.

Having everything together means you can switch between the different areas of your practice more effortlessly. All of your data is organized. And the multiple functions of your practice experience an improved flow for better tracking and budget management.

6. Quick Customer Support Set-up and Training

Your budgeting software should come from a company that values its customers. Striving to offer fast customer service for software set-up and troubleshooting of issues.

Some companies can take up to 72 hours to respond to customer inquiries. Wasting precious time on unresolved issues that need prompt attention. Look for a company that offers quick turnaround times for troubleshooting software issues.

You should also consider using a company that will walk you through the training process. Offering step-by-step set-up support, video tutorials, and a telephone helpdesk. Including relevant searchable information in an online knowledge base.

This will ensure that your budget management software set-up, training, and user experience are much smoother and worry-free processes.

7. Provides Security and Reliability

Budgeting software handles a large portion of sensitive and private data. So it is crucial that your budget management software provides the highest level of security protection.

You need budget management software that helps to keep this data safe through the use of encrypted code. As well as other security measures like a firewall. According to Norton, there may be as many as 2,200 cyber-based attacks per day, around one attack every 39 seconds.

Confidential data, like those contained inside patient files, are especially vulnerable. They may include social security numbers, personal patient payment information, and any other sensitive information.

This data will be better protected from possible data breaches and cyber-attacks. Using HIPAA-compliant budgeting software also ensures your practice follows the necessary legal data protection requirements.

Your Allied Health practice’s information is well-guarded by a reliable and trusted company.

Experience Enhanced Budget Management Software from iinsight®

When exploring budget management options, factors like trust, reliability, security, and ease of use are some of the most important areas to consider. Accessibility, customer service support and set-up, and software integration are also key.

You want budget management software that works for you, not against you. Something that streamlines your day-to-day business needs while managing your Allied Health practice. Budget management software from iinsight® is part of a larger case management software platform designed for use by Allied Health practices.

Contact iinsight® here today to start your free 14-day trial and see what it can do for you.